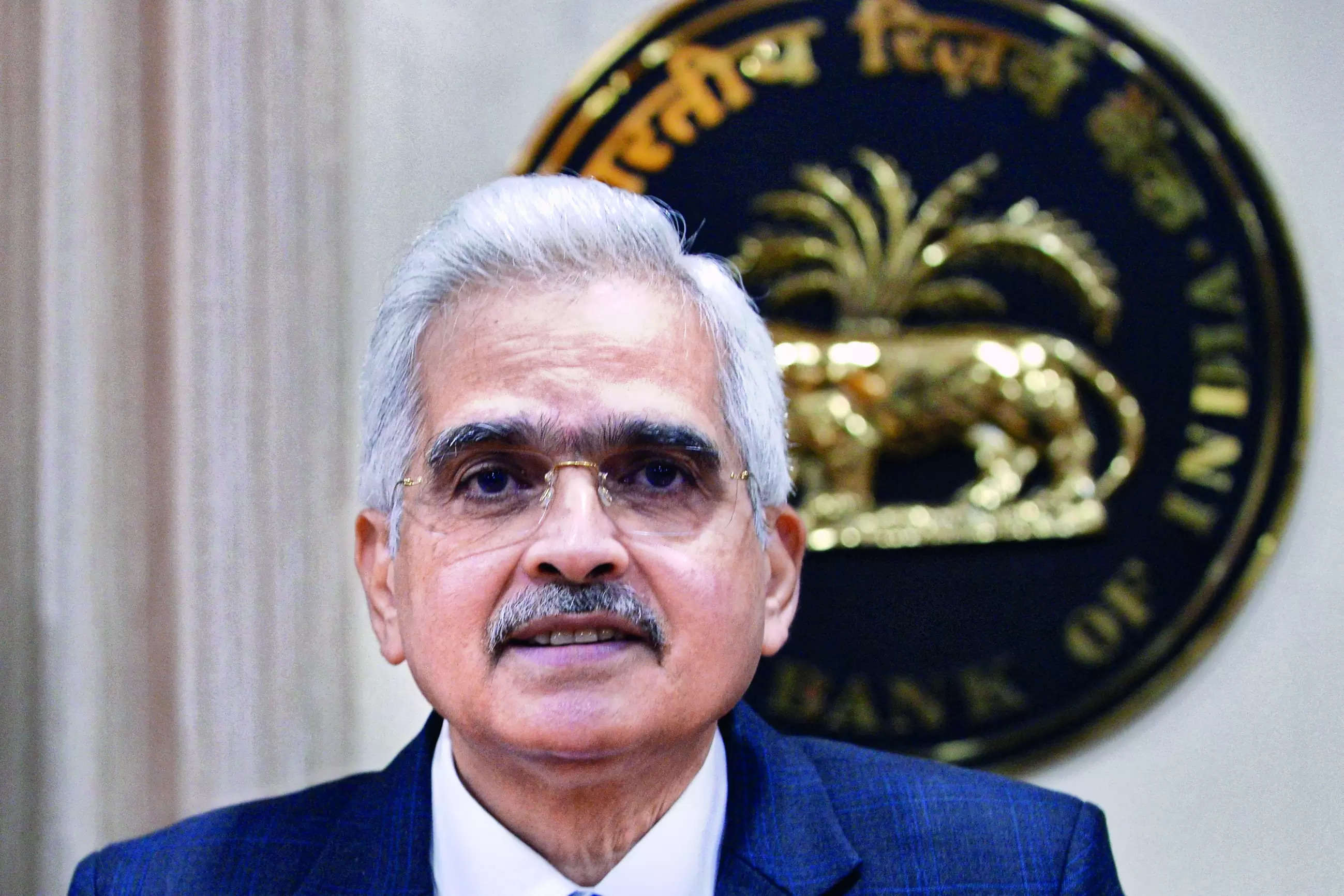

NEW DELHI: RBI governor Shaktikanta Das has said that the central bank managed to moderate inflation without compromising on its growth focus. In his new year message to the central bank’s staff, Das said that the RBI has navigated multiple challenges faced by the economy and exhorted the staff to improve the quality and efficacy of service delivery.

While pointing to the challenges posed by macroeconomic and geo-political shocks, the governor also highlighted the threat of climate change. “As Team RBI, we have been able to effectively navigate through the multiple challenges faced by us. We continued our journey with a proactive, pragmatic and prudent approach,” Das said in his year-end message to RBI staff.

“On the monetary policy front, we have managed to moderate inflation, without losing focus on growth. Our actions were timely and decisive. We have also scaled new heights in maintaining macroeconomic and financial stability. Our regulatory and supervisory policies continued to be fine-tuned to ensure a robust financial system,” the governor wrote in a two-page note.

Since May 2022, the monetary policy committee has raised key policy rates by 2.5 percentage points and, factoring in the impact of its decision, decided to pause amid moderating inflation. While it is still closely monitoring the developments, RBI is widely expected to start reducing rates later in 2024.

While RBI is seen to be done with its rate hikes, the tighter liquidity conditions have resulted in some banks hiking their deposit rates.

The governor’s comments come two days after RBI’s financial stability report ratified the strength of the country’s macroeconomic fundamentals.

While pointing to the challenges posed by macroeconomic and geo-political shocks, the governor also highlighted the threat of climate change. “As Team RBI, we have been able to effectively navigate through the multiple challenges faced by us. We continued our journey with a proactive, pragmatic and prudent approach,” Das said in his year-end message to RBI staff.

“On the monetary policy front, we have managed to moderate inflation, without losing focus on growth. Our actions were timely and decisive. We have also scaled new heights in maintaining macroeconomic and financial stability. Our regulatory and supervisory policies continued to be fine-tuned to ensure a robust financial system,” the governor wrote in a two-page note.

Since May 2022, the monetary policy committee has raised key policy rates by 2.5 percentage points and, factoring in the impact of its decision, decided to pause amid moderating inflation. While it is still closely monitoring the developments, RBI is widely expected to start reducing rates later in 2024.

While RBI is seen to be done with its rate hikes, the tighter liquidity conditions have resulted in some banks hiking their deposit rates.

The governor’s comments come two days after RBI’s financial stability report ratified the strength of the country’s macroeconomic fundamentals.