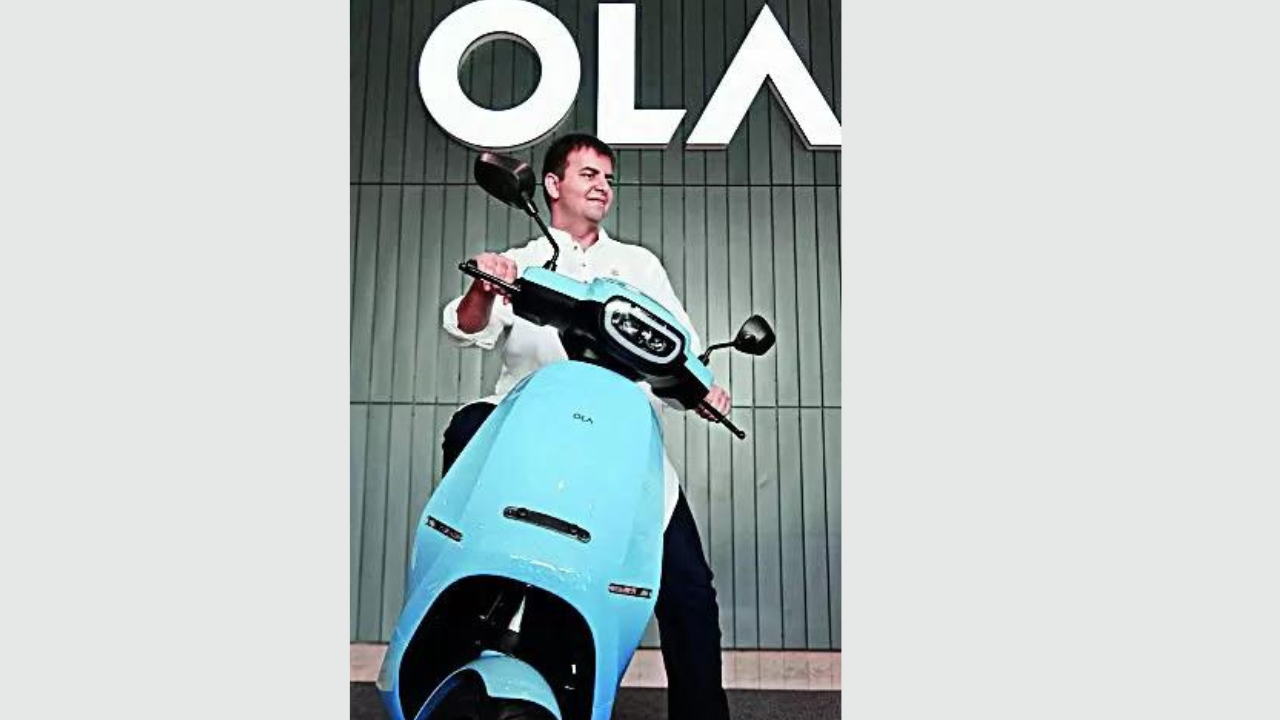

MUMBAI: Ola Electric Mobility, the Bhavish Aggarwal-led electric vehicle company, on Friday filed papers with Sebi to go public via an IPO that is estimated to be worth about Rs 10,000 crore. Ola Electric is the first EV company in India planning to go public.

It would also be the first automobile company to go for IPO in over 20 years, since Maruti Suzuki (then Maruti Udyog) went public in mid-2003.

IPO documents filed by Kotak Mahindra Capital showed that the company would raise Rs 5,500 crore through issuance of new shares. In addition, 10 shareholders are selling part of their holdings, aggregating a little over 9.5 crore shares, through this offer.

The money raised through the issuance of new shares would primarily be used for the expansion of Ola Electric’s cell manufacturing plant, repayment or pre-payment of debt by one of its subsidiaries, and investments in R&D.

The selling shareholders in the IPO include promoters Aggarwal and Indus Trust, and some early backers of the EV company – private equity firms like SoftBank, Matrix Partners and Tiger Global. Among Ola Electric’s top shareholders are Aggarwal (37%), SoftBank (22%), employees (7.7%) and Tiger Global (6%).

It would also be the first automobile company to go for IPO in over 20 years, since Maruti Suzuki (then Maruti Udyog) went public in mid-2003.

IPO documents filed by Kotak Mahindra Capital showed that the company would raise Rs 5,500 crore through issuance of new shares. In addition, 10 shareholders are selling part of their holdings, aggregating a little over 9.5 crore shares, through this offer.

The money raised through the issuance of new shares would primarily be used for the expansion of Ola Electric’s cell manufacturing plant, repayment or pre-payment of debt by one of its subsidiaries, and investments in R&D.

The selling shareholders in the IPO include promoters Aggarwal and Indus Trust, and some early backers of the EV company – private equity firms like SoftBank, Matrix Partners and Tiger Global. Among Ola Electric’s top shareholders are Aggarwal (37%), SoftBank (22%), employees (7.7%) and Tiger Global (6%).